A finance worker joined a routine video conference and wired about 25 million dollars to criminals. The call looked like a standard internal briefing. Every face and voice on the screen matched the company’s leadership. None of them were real. The meeting was a deepfake. The case shocked investigators and became a defining example of AI cybercrime for modern enterprises (Company worker in Hong Kong pays out £20m in deepfake video call scam, The Guardian. This is not an isolated stunt. AI in cybersecurity is now a two-sided contest. Offenders exploit cheap tools to impersonate executives, automate translation, and scale fraud, while defenders race to detect synthetic media and stop business email compromise.

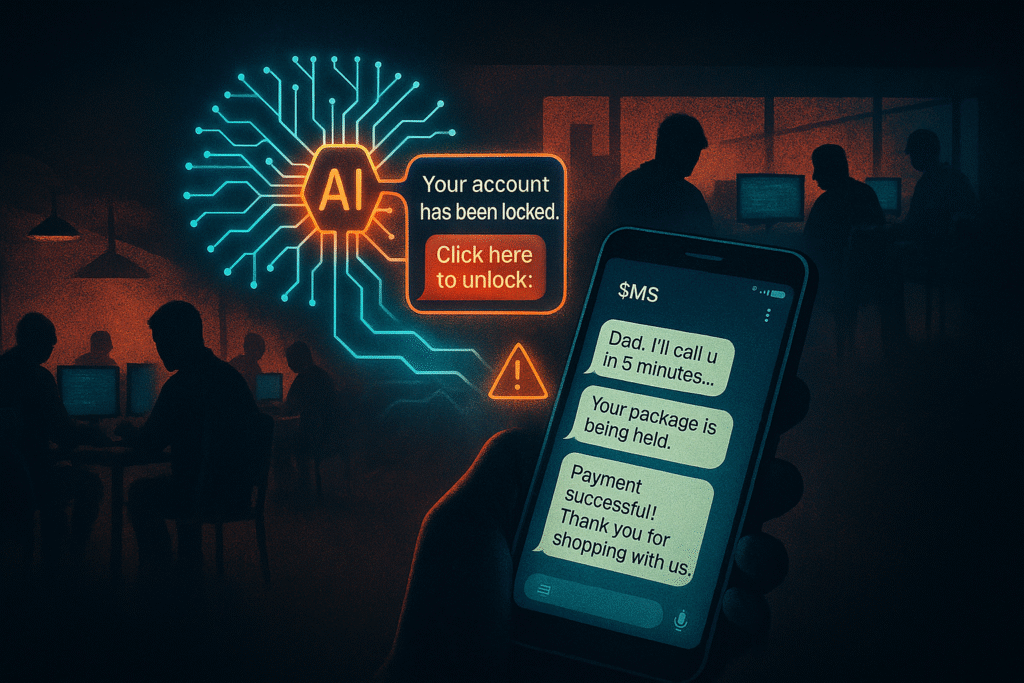

AI cybercrime is not confined to laptops in basements. It is increasingly run from industrial “scam centers” that look like call factories and operate as commercial service providers to wider criminal networks. Victims inside these compounds are often trafficked and forced to commit online fraud. This turns deepfake fraud, phishing, and account takeover into assembly-line work, not isolated incidents.

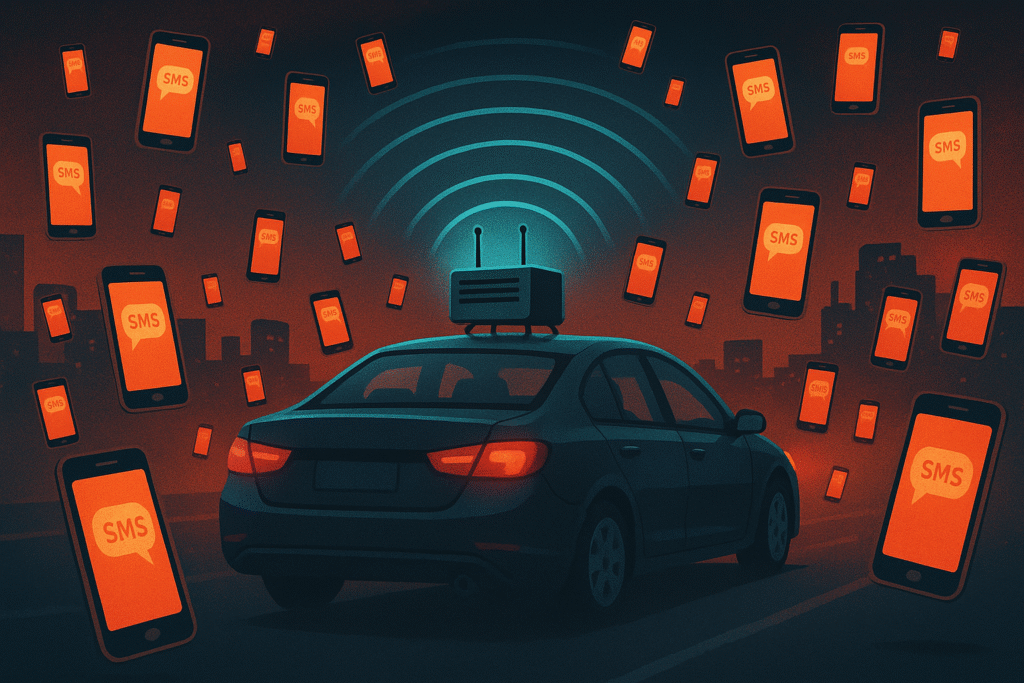

The delivery systems are evolving as well. Criminals now use “SMS blasters,” portable devices that mimic cell towers to push floods of SMS phishing messages directly to nearby phones. Because these signals can bypass normal carrier filtering, thousands of victims can be reached in minutes with near-zero cost. AI in cybersecurity must therefore account for both synthetic content and unconventional delivery vectors that do not look like traditional network traffic.

This article examines AI cybercrime through seven lenses. We start with how scam centers professionalize fraud, then track the mass distribution methods behind SMS phishing, and follow the technology stack that lets generative systems impersonate identity at scale. We assess why even seasoned teams fall for convincing synthetic media, map global implications, and close with practical defenses and active policy efforts. With that framing in place, we turn to the infrastructure that makes everything else possible.

Subscribe to our newsletter and stay one step ahead of tomorrow’s attacks.

The Rise of Industrialized Scam Centers

Southeast Asia’s Scam Compounds as Global Hubs

AI cybercrime now rides on top of physical infrastructure that looks like a call-center but functions as a transnational “criminal service provider.” UNODC describes large compounds in Southeast Asia that sell turnkey services to other gangs. These services include phishing script design, fraudulent payment processing, laundering through underground banking, and technical innovation that improves conversion rates. The report emphasizes that these hubs industrialize cyber-enabled fraud and professionalize the roles involved, from content authors to social engineers and cash-out teams. The 2025 UNODC regional study adds that these scam centers link to cross-border networks that move people, data, and money through a repeatable pipeline, which elevates the scale and persistence of AI cybercrime beyond what lone operators could accomplish.

These compounds influence tactics across many channels. Deepfake fraud becomes a scripted workflow rather than an ad hoc trick. Operators can blend synthetic video calls with parallel email or chat outreach, then loop in phone-based scripts that push targets toward irreversible transactions. The existence of these hubs explains why scam centers can sustain high-volume operations for months. The model resembles outsourced business process operations, except the product is deception at scale. For AI in cybersecurity, the implication is clear. Defenders must model the adversary as an organization with standard operating procedures, not a set of random one-offs, and treat AI cybercrime as a managed service with supply chains and measurable output.

Forced Labor and Human Trafficking in Cybercrime

Behind the throughput of these scam centers is a humanitarian crisis. UN human rights experts warn of large-scale trafficking into compounds where people are coerced into conduct that constitutes criminal activity. Victims are subjected to threats, abuse, and movement restrictions, then forced to run online scams for extended periods. This coerced model creates a constant labor pool for phishing and social engineering, which allows scam centers to keep costs low and volume high.

The cycle strengthens the economics of AI cybercrime, since the labor force can be trained to operate generative tools that personalize messages or stage synthetic calls on demand. The UN has urged immediate human rights-based action, cooperation among states, and protections for victims who are compelled to participate in digitally mediated crimes.

This combination of organizational structure and coerced labor explains why scam centers have become durable. It also sets the stage for the next mechanism of scale, which is the rapid distribution of messages using hardware that bypasses normal network controls.

Industrialized scam operations rely on cheap labor and SMS blasters, but criminals are also experimenting with advanced AI listening techniques. Our analysis of AI Acoustic Side-Channel Attacks: 5 Shocking Security Risks shows how attackers can steal sensitive data by “hearing” keystrokes and phone conversations through everyday devices.

SMS Blasters and the Mass Production of Phishing

How SMS Blasters Work

AI cybercrime now exploits radio hardware that hijacks the delivery channel. “SMS blasters” are portable devices that impersonate legitimate cell towers, then push high volumes of text messages directly to phones in range. Reporters documented criminals driving through neighborhoods with a car-mounted unit that can push tens of thousands of messages per hour, which turns SMS phishing into a mobile broadcast system with minimal cost per victim. UK authorities have reported real-world arrests tied to a similar car-based system, confirming that this is not a lab concept but an operational tool that feeds AI in cybersecurity threats at scale.

For organizations tracking AI cybercrime, this matters because delivery no longer relies on email infrastructure or carrier gateways that defenders expect to monitor.

Once a rogue base station convinces nearby phones to attach, the operator can rotate caller IDs, spoof brands, and seed links to convincing phishing pages generated by language models. This hardware pipeline multiplies the reach of scam centers by delivering messages that look local and urgent. It also blends well with deepfake fraud, since an SMS thread can prime a target before a synthetic voice call arrives minutes later. Technical observers have flagged a steady rise in these incidents, noting that the barrier to entry is falling as kits and tutorials circulate in criminal markets. The combined effect is a durable distribution layer that keeps AI cybercrime efficient, fast, and cheap.

Hackers move fast. Governments do not. Get weekly insights on AI-driven threats, SMS phishing tradecraft, and deepfake fraud before they hit the headlines. Subscribe now to the Quantum Cyber AI Brief to join readers who track AI in cybersecurity with practical defenses and policy context.

Why Traditional Defenses Are Struggling to Keep Up

Carrier spam filters are designed to score and block messages that traverse carrier-controlled networks. SMS blasters bypass those networks entirely by transmitting directly over radio, so the malicious traffic never passes through the filtering stack that mobile providers maintain. This is why conventional takedown playbooks do not cut volume quickly. By the time a brand reports abuse, the vehicle may have moved, the device IDs have changed, and the sender identities have rotated. Law enforcement cases show the practical difficulty of attribution at street level, even when investigators know a car-mounted unit was used to seed an SMS phishing wave in a city district.

The implication for AI cybercrime defense is direct. Security teams must shift from network-only controls to device and user workflow controls, such as platform-level link protections, session-binding for authentication, and mandatory callback verification for transactions initiated by text. These measures blunt the follow-on phases that criminals want to trigger, including credential capture and deepfake fraud over voice or video. When combined with resilient user training that emphasizes channel verification, organizations can cut the conversion rate that scam centers depend on to fund operations. With delivery mechanics in view, we can now examine how generative systems supercharge the content itself and turn ordinary phishing into multilingual, high-conviction lures in the next phase of AI in cybersecurity.

AI as a Criminal Accelerator

Generative AI for Fraud at Scale

AI cybercrime thrives because generative tools make convincing content cheap, fast, and multilingual. Europol’s latest assessments warn that organized groups now automate phishing templates, spoofed domains, and realistic impersonations across languages, which expands the target pool and improves conversion rates. The EU-SOCTA 2025 report describes a maturing ecosystem where criminal marketplaces provide ready-made prompts, cloned websites, and step-by-step playbooks for social engineering, which turns AI cybercrime into a repeatable service line inside larger networks.

Generative models remove the friction that used to limit non-native speakers or low-skill operators. A team inside scam centers can spin up branded emails, chat scripts, and fake landing pages in minutes, then run rapid A/B tests to optimize persuasion. The same pipeline creates content for SMS phishing, voice scripts, and executive impersonation emails. This is where AI in cybersecurity must evolve. Defenders need to assume that every lure will be grammatically correct, culturally tuned, and visually aligned with a victim’s industry, because the adversary can generate hundreds of variants per hour.

These scams are not just nuisances. They are part of a global arms race. Our piece on the AI Cybersecurity Arms Race: 7 Alarming Signs Hackers Are Winning shows how cybercriminals are scaling up faster than defenders can keep pace. The baseline assumption for professionals should be simple. AI cybercrime is an operations problem as much as a detection problem.

Automation also improves scale. Instead of a handful of manual phishing emails, criminals can push out tens of thousands of tailored lures and then route positive responses to human agents for live social engineering. Europol assesses that these AI-augmented, cross-language campaigns are reshaping fraud-as-a-service offerings, which further accelerates AI cybercrime as a global business model. When combined with distribution vectors like SMS phishing hardware and the call-center discipline of scam centers, the result is a full-stack operation that can run for months without exhausting targets.

Lowering the Skill Barrier for Attackers

AI in cybersecurity now confronts adversaries who do not need deep technical skills. The FBI’s Internet Crime Complaint Center reported a record 16.6 billion dollars in losses for 2024, with fraud at scale driving the totals. Law enforcement highlights that easy-to-use AI tools amplify phishing and social engineering by making scripts and websites accessible to novices who would have struggled before. The FBI’s San Francisco office has warned that criminals are adopting AI to generate convincing content and to automate parts of the attack chain, from initial contact to payment instructions, which lowers the bar for entry and increases the speed of AI cybercrime operations.

This shift changes team priorities. Security leaders should expect credible lures in every channel and plan controls that assume some employees will engage. That means enforcing out-of-band verification on any transaction request, instrumenting stronger identity-proofing on risky workflows, and moving to phishing-resistant authentication that cannot be captured by cloned pages. It also means mapping the full attack pipeline in tabletop exercises that include AI-generated content, mobile delivery through SMS phishing kits, and follow-on deepfake fraud over voice or video. AI cybercrime is now the default backdrop for enterprise risk. The next section examines how deepfake fraud turns that backdrop into direct identity abuse and high-dollar losses.

Deepfake Frauds and Identity Theft at Scale

Voice Cloning Technology

AI cybercrime now includes industrialized identity mimicry. Voice cloning tools can reproduce a speaker’s tone and cadence with only minutes of sample audio, which allows criminals to script calls that sound like executives, customers, or government officials. Europol outlines how synthetic voices and manipulated video complicate evidence chains for investigators and enable fast-moving impersonation schemes that bypass routine skepticism. The Federal Trade Commission warns that family emergencies, company payment approvals, and credential resets are common scenarios for this kind of deepfake fraud, often seeded with personal data scraped from public profiles.

These capabilities are not theoretical. They form a repeatable attack step inside scam centers, where operators can chain synthetic audio with pretext calls and follow-up emails. The result is a credible, multi-channel push that often lands before security teams detect any anomaly. Because AI in cybersecurity must assume high-quality synthetic media by default, controls need to test intent and authority, not just the apparent identity on a call or video. Short, scripted verification routines, independent callbacks, and transaction holds are practical ways to slow AI cybercrime long enough for a secondary check to run.

Real-World Deepfake Scams

The scale and speed of AI cybercrime are best seen in recent cases. A finance worker in Hong Kong wired about 25 million dollars after a video conference in which the CFO and colleagues were convincingly faked, complete with realistic faces and voices. Italian police later froze funds linked to a voice clone that imitated the country’s defense minister in an attempt to defraud business leaders, a case that underscores how credible audio is enough to open doors even without elaborate visuals.

These incidents rarely happen in isolation. Operators often warm targets with SMS phishing to build context, then escalate to a synthetic call that demands urgency. The front end may look like a familiar brand security alert. The back end may be a coordinated crew inside scam centers that routes any responding victim to a human closer who finalizes the transfer. This choreography is why AI in cybersecurity must pair media forensics with process controls.

Even strong detection will miss some deepfake fraud, so the kill switch must live in the workflow for payments, data access, and vendor onboarding. Clear verification scripts, strict segregation of duties, and hard limits on real-time approvals reduce the conversion rate that fuels AI cybercrime across regions. With these mechanics in view, the next question is why trained professionals still get fooled when the stakes are obvious and the procedures look sound, which takes us to the human factors driving the next phase of attacks.

Why Even Professionals Are Falling for AI-Enabled Scams

AI cybercrime succeeds in part because it weaponizes familiar cues that people rely on to make quick judgments. Deepfake fraud and voice-clone calls reproduce cadence, tone, and visual identity in ways that bypass routine skepticism. The FBI warned that deepfake audio has been used to impersonate officials and to pressure victims into urgent action, which short-circuits normal verification behaviors. That single factor helps explain why experienced finance, legal, and operations professionals have transferred large sums after receiving what sounded like an executive approval.

The scale of the problem is also financial and structural. Business Email Compromise remains one of the costliest cybercriminal trades. The FBI’s IC3 reports internet crime losses of $16.6 billion in 2024, driven in large part by fraud and impersonation schemes that now incorporate AI-generated content. NACHA’s analysis corroborates the trend, noting billions lost to BEC over recent years, which signals systemic risk for corporations that treat email and voice as equivalent proofs of authority. When attackers combine email, SMS phishing priming, and a synthetic call, the operational pressure on staff to act quickly rises and decision rules break down.

High-profile attempts show how convincing the attacks can be. Executives at major firms were targeted with voice-clone and impersonation campaigns that mimicked leadership and suppliers, including attempts against WPP and Wiz leadership. These cases often start with a highly plausible context, such as a vendor change or an emergency payment, which reduces the perceived need for out-of-band checks. That perceived urgency is the psychological lever AI cybercrime exploits.

Human factors research on social engineering shows that authority, scarcity, and social proof predict compliance. AI in cybersecurity amplifies those triggers by making the authority signal literal. A cloned voice asking for immediate approval is a much stronger nudge than a poorly written phishing email. For practitioners, this means defense cannot rely solely on technical detection of synthetic media. It must also harden human workflows and decision gates. Require two-person approvals for large transfers, enforce mandatory callbacks on verified lines, and instrument approvals through authenticated enterprise portals rather than accepting confirmations via SMS or ad hoc voice.

CISA and NCSC guidance emphasizes phishing-resistant authentication and process controls for high-risk transactions, which reduces the exploitable surface that AI cybercrime aims to manipulate.

Finally, training must evolve. Traditional awareness modules that focus on poor grammar and spoofed domains are obsolete when generative models create near-perfect lures. Tabletop exercises should simulate multi-channel attacks that combine SMS phishing, synthetic audio, and fraudulent invoices. Red teams must be empowered to validate controls under realistic AI-augmented scenarios. Strengthening human procedures reduces conversion rates and directly undermines the economics of scam centers that rely on high-volume, low-cost fraud.

This human layer is the bridge to global impacts, because when trained professionals are deceived, the losses and political consequences scale quickly. In the next section we assess those global implications and how AI cybercrime ripples across finance and national security.

The Global Implications of AI-Powered Cybercrime

Expansion Beyond Southeast Asia

AI cybercrime has scaled from regional hotspots to a transnational operating model that treats borders as routing details. Europol’s IOCTA 2025 describes a data-driven criminal ecosystem where stolen credentials and personal data are recycled in repeated attack loops, which lets syndicates expand from local fraud to cross-border operations with minimal friction. The report highlights how scam centers industrialize the pipeline and then sell access and tooling to affiliates, which turns isolated incidents into persistent campaigns that adapt to enforcement pressure. This is the next stage of AI in cybersecurity. Defenders face adversaries that operate like multinational vendors with playbooks, service tiers, and measurable conversion metrics.

The infrastructure is modular. One crew handles SMS phishing distribution through portable base stations. Another crew runs content operations that include deepfake fraud and multilingual lures. A third crew monetizes stolen assets through mule networks and crypto exchanges. Europol’s public summary emphasizes that this specialization accelerates learning and reuse across regions, which explains the rapid spread of techniques once they prove profitable. AI cybercrime benefits from this division of labor because language models and automation make it easy to clone success patterns at scale, then plug them into delivery channels that evade traditional filters. The result is a globalized baseline where attacks tested in one market can be ported worldwide in days.

The Ripple Effect on Finance, Politics, and National Security

The knock-on risks go beyond direct fraud losses. Europol warns that AI enables proxy operations for hostile powers, including influence and disruption campaigns that ride on the same infrastructure used for criminal profit. This convergence increases systemic risk because a single network can switch from theft to destabilization without retooling its stack. Reuters reports similar concerns, noting that organized groups are using AI to automate impersonation and scale multilingual fraud that intersects with political manipulation and corporate espionage. For security leaders, this means AI cybercrime is not just an economic drain. It is an operational risk to governance, elections, and supply chains.

Financial impact compounds through secondary effects. A successful deepfake fraud case that drains working capital can trigger covenant breaches or vendor delays. A wave of SMS phishing can seed enough credential theft to fuel ransomware affiliates for months.

The bigger danger is what comes next. Criminals will not stop at text-message fraud. They are already probing ways to weaponize future artificial general intelligence. Explore the Artificial General Intelligence: 5 Overlooked Conflict Risks we have identified, and see how early scams may be test runs for something far more destabilizing. The same criminal networks behind scam centers can pivot into data theft and extortion without rebuilding their workflows, which is why AI in cybersecurity must be managed as an enterprise resilience problem, not only a detection challenge.

These global patterns set up a practical question for boards and agencies. How do we reduce attacker conversion rates when content is convincing, delivery bypasses carrier filters, and operations scale across regions. The answer begins with specific controls that blunt each phase of the attack chain, which we address next.

Defensive Strategies Against the Next Wave

What Organizations Can Do Now

AI cybercrime requires layered controls that assume some employees will click and that some detections will fail. Move high-risk workflows to phishing-resistant authentication such as FIDO2 security keys. CISA provides specific implementation guidance that reduces credential theft from cloned sites and man-in-the-middle kits. Large agencies have already demonstrated successful rollouts of FIDO that cut account takeover, which shows that strong authentication can scale without crippling usability.

Assume SMS phishing will bypass carrier filters and design defenses at the device and workflow layers. Use mobile link protections that detonate or rewrite suspicious URLs, require session-binding for step-up authentication, and mandate out-of-band callbacks on verified numbers for any financial or access change. UK NCSC guidance stresses rapid reporting channels and practical user controls that reduce the dwell time between a suspicious message and security action, which directly lowers conversion rates for scam centers.

Pair these controls with strict change management for vendor banking details and with two-person approval on large transfers. That way deepfake fraud has fewer opportunities to exploit urgency during an executive impersonation call. Train using realistic exercises that combine AI in cybersecurity adversary methods across channels. Include SMS phishing warmups, synthetic voice prompts, and parallel email pressure so teams practice the full sequence that AI cybercrime uses in the wild.

Finally, measure the basics. Track how often users report suspicious messages, how quickly tickets are triaged, and how many attempted transfers are halted by verification rules. The metrics help boards understand residual risk and show where additional investment is needed to close gaps created by multilingual, high-quality lures. These steps will not eliminate attacks. They will make AI cybercrime more expensive to operate and less reliable as a business.

Policy and Regulatory Actions

Policy momentum is building around impersonation. The Federal Trade Commission has proposed protections that target AI-enabled impersonation of individuals, which creates clearer enforcement paths for cases that today sit in gray zones between fraud, privacy, and consumer protection. The FTC is also educating consumers and businesses on voice cloning risks, including playbooks for verification and incident response that organizations can adapt for executive impersonation scenarios linked to deepfake fraud.

Security leaders should align internal policies to these regulatory signals. Update incident definitions to explicitly include AI impersonation, synthetic audio, and synthetic video. Require legal and compliance teams to track FTC actions so response plans and vendor contracts reflect new standards as they emerge. This ensures AI in cybersecurity programs keep pace with changing expectations while creating a defensible posture when regulators or insurers review controls after a major event. When combined with strong technical baselines from CISA and operational guidance from NCSC, these policy moves give organizations a blueprint to blunt the economics that make SMS phishing and scam centers so effective.

Controls and policy only matter if they change behavior. The final piece is turning these practices into board-level priorities and measurable goals that survive budget cycles. That is where we now turn in the conclusion, which distills what to do in the next two quarters and how to plan for the next twelve months.

Conclusion

AI cybercrime has moved from isolated acts to a coordinated system that blends industrialized scam centers, SMS phishing hardware, and generative tools into a full-stack operation. The pattern is clear. Criminal groups reuse stolen data, test content like a marketing team, and switch channels when one defense improves. Executives and practitioners should treat AI in cybersecurity as an enterprise resilience problem, not a narrow detection challenge. That means investing in phishing-resistant authentication, hard gating high-risk approvals, and running exercises that simulate multi-channel attacks, including deepfake fraud seeded by realistic voice cloning and primed by convincing texts.

The policy landscape is beginning to catch up. The Federal Trade Commission is pressing on AI-enabled impersonation standards, and security agencies continue to publish practical controls that make SMS phishing and executive impersonation less profitable to run. Boards should align internal policies to these signals and demand measurable outcomes, such as reduced time to verify requests and higher employee report rates for suspicious messages.

The next twelve months will test whether organizations can lower attacker conversion rates faster than adversaries can scale content and delivery. That is the real contest in AI cybercrime. Teams that bind identity to hardware keys, force callbacks on money movement, and rehearse decision points will see fewer losses, even as criminals refine deepfake fraud and expand SMS phishing through portable base stations.

AI in cybersecurity will remain a moving target. The advantage goes to leaders who operationalize controls, adapt quickly to new tradecraft, and build muscle memory across finance, legal, and IT. Treat AI cybercrime as a predictable business model, then make that business unprofitable in your environment. That is how you shift the risk curve in your favor.

Key Takeaways

- AI cybercrime is now industrialized through scam centers that organize labor, scripts, and cash-out, which explains the persistence and scale documented by UNODC and Europol.

- SMS phishing has a new delivery rail. Portable transmitters can bypass carrier filters and seed thousands of lures locally, which requires device and workflow controls to contain impact.

- Generative content improves conversion. Attackers can launch multilingual, on-brand lures that look legitimate, so AI in cybersecurity must assume perfect grammar and plausible context by default.

- Deepfake fraud raises the ceiling on losses. Synthetic voices and video can spoof authority and accelerate approvals, which demands out-of-band verification and strong segregation of duties.

- The fastest gains come from basics done well. Enforce phishing-resistant MFA, callback verification on money movement, and realistic simulations that blend channels to reduce the conversion rate that fuels AI cybercrime.

FAQ

How does AI cybercrime change phishing risk for enterprises?

AI turns one-size-fits-all phishing into tailored, multilingual campaigns that mirror brand tone and industry jargon, which increases click and reply rates across regions. AI in cybersecurity must address content quality, not just volume.

What exactly is an SMS blaster and why is it hard to block?

It is a portable transmitter that mimics a cell tower and sends messages directly to phones nearby. Carrier spam filters often miss this traffic because it does not traverse their normal gateways. This reinforces the need for device and workflow defenses against SMS phishing.

Why do trained professionals still fall for deepfake fraud?

Synthetic voices and video reproduce authority signals that people trust. When paired with urgency and a plausible business context, the pressure to act can override normal checks, which is why callbacks and two-person approvals help slow AI cybercrime.

What first steps should a mid-size firm take in the next quarter?

Adopt FIDO2 keys for administrators and finance, script mandatory callbacks for any banking change, and run a simulation that chains SMS phishing with a voice-clone call. These moves harden identity and reduce the yield that scam centers expect from their playbooks.

Where can I learn more about defensive AI and trust erosion?

Review our analyses The Cybersecurity Arms Race: AI vs AI and Deepfakes and the Erosion of Digital Trust. Both connect AI in cybersecurity strategy to real controls that counter AI cybercrime while addressing the social and organizational impacts that make attacks effective.